Will Moving Services Be Cheaper Under the Trump Administration

By PAGE Editor

Will Moving Services Be Cheaper Under the Trump Administration? An Impact Analysis

In the world of moving services, the question on everyone’s mind is: will relocation become more affordable under the Trump Administration? As we navigate through fluctuating costs and shifting policies, it’s essential to dissect the various factors impacting this industry. From tax reforms to regulations on transportation and safety, each element plays a role in determining what consumers ultimately pay. This article aims to unravel these complexities, examining how leadership decisions affect everything from corporate giants to local movers—and even your budget when you’re planning a big move. By diving into the specifics, we'll uncover whether potential savings are on the horizon or if hidden costs might sabotage our relocation dreams.

While some proposed economic policies may suggest potential tax cuts or incentives that could affect operational costs, current trends indicate that existing legislation favoring offshoring may counteract any reductions in moving service prices. For significant changes to occur that lower costs, substantial reform in tax policy would be necessary rather than temporary measures.

Examining Moving Costs During the Trump Administration

The landscape of moving costs underwent notable shifts during the Trump Administration, largely driven by its pro-business initiatives. Deregulation became a catchphrase, promising to ease the burden on industries—including moving services. This meant fewer regulations governing operations, which can translate into operational efficiencies for moving companies. As these companies saved on compliance costs, they often had more room to adjust their pricing structures favorably for consumers looking for competitive pricing by movers.

For instance, the Tax Cuts and Jobs Act enacted in 2017 provided an unprecedented opportunity for moving businesses to cut their operating expenses. The timing couldn’t have been more advantageous; many companies began to reevaluate their financial models and overhead costs shortly thereafter. This tax break not only incentivized them to enhance their services but also allowed a portion of those savings to trickle down to clients in the form of lower service fees.

According to a survey conducted by the American Moving & Storage Association (AMSA), approximately 20% of moving companies reported reducing their rates following the tax reform—a significant consideration for anyone looking to relocate on a budget.

However, it wasn't just tax cuts influencing prices; federal tariffs served as another layer that could possibly alter costs. President Trump's approach towards foreign manufacturing sometimes led to heightened tariffs on imported materials. These increases made certain supplies exponentially more expensive for moving companies if they were sourcing products from overseas. If a company using imported packing materials faced increased shipping costs, they might pass those expenses directly onto consumers through higher pricing.

On top of that, while deregulation was intended to lower operational costs, there remained concern surrounding infrastructure investments due to the Infrastructure Investment and Jobs Act (IIJA). Should funding decrease or priorities shift within this act, it could impact transportation logistics—this is particularly relevant when discussing how quickly and efficiently goods can be moved across states and regions.

With these variables in play, it becomes increasingly important to consider how additional factors—such as local taxes and fuel prices—can further influence moving costs during this administration’s tenure. Understanding these dynamics will shed light on broader financial implications pertaining to relocation efforts.

Federal Taxes Impact on Relocation Services

Federal tax policies can create a significant ripple effect across the moving industry, directly influencing both costs and the nature of available services. For instance, while larger moving corporations have found themselves at an advantage due to lower corporate tax rates – which dropped from a staggering 35% to a more modest 21% – smaller, independent movers struggle to keep pace. This reduction in tax rates allows larger companies not only to reinvest their savings into state-of-the-art technology but also to enhance their fleet systems, ultimately driving down operational costs.

It’s a classic tale of survival of the fittest, where those with deeper pockets can adapt more quickly and effectively.

While larger firms take technological leaps, many smaller moving companies consist of local operations that lack such financial leverage. They often find themselves relying on older equipment and less efficient methods simply because they can't afford more modern innovations.

On the other hand, for individual taxpayers, especially those who undertake relocations for work-related reasons, the consequences of federal tax changes have been substantial. The temporary suspension of moving-expense deductions for non-military personnel adds a layer of financial stress that takes a toll on one’s budget when planning a move. According to IRS data, around 11% of taxpayers once relied on these allowances but now face a heavier financial burden, absorbing costs that were previously written off. This shift means individuals might think twice before relocating and could potentially limit job mobility.

Without moving-expense deductions, individuals may need to factor in:

Increased rental deposits

Costs associated with packing materials

Hiring professional help or renting trucks

Fees for utility disconnections and reconnections

Clearly, the implications of these tax changes reach beyond mere figures; they alter the landscape in which relocation services operate and influence how individuals perceive moving expenses.

Moreover, legislators aiming to create incentives through potential deductions could sway public sentiment towards moving as a feasible option again. Nevertheless, until such developments materialize, it increasingly falls upon individuals to strategically plan their moves, carefully assessing all potential costs involved.

As we explore further, it becomes clear just how complex and interwoven federal tax policies are with practical elements of relocation services—impacting individuals from both logistical and emotional standpoints alike.

Influence of Transportation Regulation Changes

Changes in transportation regulations can significantly ripple through the moving services industry. For instance, the Federal Motor Carrier Safety Administration (FMCSA) made notable adjustments to certain hours-of-service (HOS) rules during the Trump administration. While designed to provide more flexibility for truck drivers, these changes also stirred up safety concerns among professionals in the field.

On one side of the coin, lifting restrictions on driving hours might sound advantageous for moving companies wanting faster service. If drivers are allowed to work longer hours, they can complete moves more swiftly, potentially leading to shorter wait times for customers. However, as some experts point out, this adjustment may come at a cost. The increased potential for driver fatigue could lead to higher accident rates on the road.

This raises an important question: How much does safety truly factor into our moving rates? If accident rates rise due to more lenient driving hours, insurance premiums are likely to swell, and those costs will inevitably trickle down to consumers in the form of higher moving expenses.

While deregulation can reduce some operational costs by allowing companies to maximize their productivity, it often overlooks critical factors like safety. Irrespective of the dollar signs saved from regulatory changes, if businesses face heightened liability and insurance costs due to accidents or incidents on the road, customers may find themselves paying even more than anticipated.

As we explore how external forces influence pricing structures further, it's essential to grasp how various economic elements interplay with safety and regulation-related expenses, ultimately shaping the landscape for moving service prices.

Economic Variables Affecting Costs

Various economic factors can influence the cost structure of moving services, and understanding these nuances is essential for both consumers and service providers alike. For example, fuel prices are one of the most straightforward costs that directly impact the overall pricing of moving services. When fuel prices rise, so do the expenses associated with transportation. This relationship was notably evident during the Trump administration when market policies regarding oil supply and demand fluctuations caused noticeable changes in fuel costs.

According to data from the Energy Information Administration (EIA), we saw a 10% decrease in national average gasoline prices in 2019; this decline translated into lower operational expenses for moving companies and, consequently, reduced moving costs for consumers.

However, fuel prices are just one piece of a much larger puzzle. As the economy ebbs and flows, inflation remains another pivotal factor that affects nearly every industry, including moving services. Labor costs are especially sensitive to inflation; as consumer price levels increase, workers often demand higher wages to maintain their standard of living. This pressure on wages can lead to elevated labor costs for moving companies, which might be passed down to customers through increased service fees. Indeed, if inflation continues its upward trajectory, interested parties—from consumers to movers—need to remain vigilant about potential pricing shifts.

In addition to fuel and labor considerations, there are also macroeconomic dynamics worth noting. The very fabric of consumer confidence plays a crucial role. In times when people feel secure in their financial future—perhaps due to stable employment or anticipated increases in income—they are more likely to seek out and invest in moving services. Conversely, during times of economic uncertainty when disposable income shrinks due to budget constraints or policy changes, demand for moving services may plummet. It’s this delicate dance between trust in the economy and actual financial health that often dictates the volume of business seen by moving companies.

Understanding how these variables interconnect is vital for anticipating pricing changes within any administration's economic landscape.

By grasping these dynamics—the interplay among fuel prices, inflationary pressures on labor costs, and fluctuating consumer confidence—we gain insights that lead us into deeper discussions about broader implications on the industry itself.

Impact on the Moving Industry as a Whole

As we explore the implications of potential shifts under the Trump administration, it's important to recognize that the moving industry operates like an intricate ecosystem influenced by various external factors. With deregulation serving as a double-edged sword, larger firms may find themselves at an advantage, leveraging resources to capitalize on market opportunities.

This consolidation trend could leave smaller moving companies vulnerable, struggling to compete without the same financial backing or reach.

An increase in competition often leads to innovative strategies as firms hustle to differentiate themselves. The resulting shifts could significantly influence pricing structures and service offerings across the industry.

A case in point would be John Doe's experience at ABC Moving, where post-tax reform led to a surge in business activity. However, as he noted, "Increased competition and fluctuating fuel prices made long-term predictions difficult." This encapsulates how quickly things can change in the moving industry; a promising boost can just as easily be offset by unforeseen challenges in logistics and fuel costs.

The Role of Oil Prices and Interest Rates

Fluctuating oil prices heavily influence logistics costs, which are critical for the moving sector. According to the US Energy Information Administration (EIA), changes in petroleum prices directly affect transportation expenses. Should oil prices rise sharply due to geopolitical tensions or domestic supply constraints, consumers might see this increase reflected in their moving service bills.

In contrast, lower interest rates may ease borrowing costs for both consumers and businesses alike. After significant cuts by the Federal Reserve in late 2024, obtaining affordable financing options for moving costs becomes more attainable. This potentially allows individuals to invest in more comprehensive services or upgrades without the burden of hefty financial commitments.

Furthermore, trends related to natural gas usage also merit consideration. As utilities increasingly lean on natural gas for energy production, its adoption could reshape transportation dynamics in the moving industry. If this trend persists, we might observe a shift in fuel consumption patterns among moving companies reliant on traditional diesel engines.

Understanding these dynamics highlights how various factors interplay within the moving industry. As established firms adapt to new economic conditions and emerging trends shape consumer behavior, it's crucial to look back at previous administrations for insights into similar scenarios.

Comparison with Previous Administrations

When considering how moving services may be impacted under the Trump administration, it's insightful to draw comparisons with preceding governments, especially regarding policies that shape operational costs, environmental regulations, and overall industry health. Under the Obama administration, an emphasis was placed on stringent environmental and safety regulations designed to protect consumers and promote sustainable practices. This led to increased operational costs for many moving companies as they needed to comply with these enhanced standards. However, it also resulted in safer roads and a reduced environmental footprint—benefits that some might argue offset the initial financial burdens.

The comparison is not just about dollars and cents; it illustrates a balancing act between cost reduction and maintaining safety and environmental integrity.

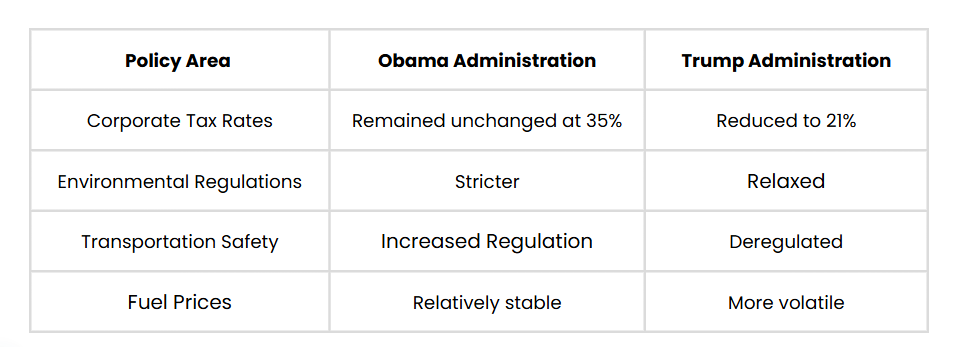

Looking specifically at the Trump administration's policies reveals a stark contrast. The table below summarizes key areas where changes were implemented:

This table drives home the point that while the lower corporate tax rate and relaxed regulations under Trump might reduce operational costs for moving companies, these benefits come at a potential expense. Deregulation could lead to more accidents or unsafe working conditions if companies prioritize profit over safety measures. Additionally, volatile fuel prices complicate budget planning for transportation businesses. How firms adapt to these shifting landscapes will determine their profitability and operational integrity.

It becomes clear that the interplay between reduced costs and heightened risks is significant. As companies navigate this new terrain with changing regulations, careful consideration must be given not only to immediate savings but also to long-term sustainability and responsibility. For instance, while cutting corners may seem financially tempting in the short term, the resulting reputation damage from poor service or safety incidents could prove detrimental in the long run.

Overall, this examination of previous administrations provides critical insight into how changes in policy can ripple through various industries; understanding this can help us predict trends moving forward in the moving industry under current leadership.

In summary, the effects of Trump's policies on moving services will rest on a delicate balance between cutting costs and ensuring quality service. Companies need to weigh their strategies carefully amidst this dynamic landscape.

HOW DO YOU FEEL ABOUT FASHION?

COMMENT OR TAKE OUR PAGE READER SURVEY

Featured

Nobody starts out as a cigar aficionado.